Gold futures look set to end four session decline

SAN FRANCISCO (MarketWatch) — Gold futures on Monday looked set to end a

four session decline, finding support from turmoil in Ukraine after a

weekend referendum on the secession of regions in the eastern part of

the country threatened to increase tensions between the West and Russia.

Copper prices were also a standout, with prices poised for their highest

close in more than two months in the wake of a new blueprint for

capital-market reforms in China, the world’s biggest consumer of the

metal.

Gold for June delivery

GCM4

+0.84%

rose $11.80, or 0.9%, to $1,299.40 an ounce on the Comex division of

the New York Mercantile Exchange after tapping a high of $1,304.50 in

electronic trading. July silver

SIN4

+2.43%

rose 48 cents, or 2.5%, to $19.60 an ounce.

Pro-Russian separatists declared victory

in Sunday’s recession referendums, contributing to rising tensions as

Moscow appeared to challenge assertions by Western powers and Kiev that

the vote was illegitimate.

“This matter remains a potential geopolitical powder keg and it appears

the fuse is now lit. Gold has and will likely continue to see safe-haven

buying amid the escalating Russia-Ukraine conflict,” said Jim Wyckoff,

senior analyst at Kitco.com.

Stocks rallied around the globe, with China posting strong gains

after the introduction of a blueprint for an overhaul of capital-market

regulations. U.S. stocks traded solidly higher, with the Dow Jones Industrial Average

DJIA

+0.60%

setting an all-time high.

Looking ahead, strategists at Barclays said gold was likely to remain

stuck in a range, with the lack of investor appetite to push gold higher

evident in the reduction of exchange-traded fund gold holdings over the

past month. They see gold maintaining a choppy, range-trading pattern

between $1,265 and $1,330 an ounce.

Copper at two-month high

Copper prices, meanwhile, soared along with Chinese indices “after the

country’s government announced over the weekend plans to allow more

foreign investment in listed shares, increase capital flow quotas, and

develop tools for increasing commodity trading,” said Colin Cieszynski,

senior market analyst at CMC Markets.

July copper

HGN4

+1.95%

tacked on nearly 7 cents, or 2.2%, to $3.15 a pound. Tracking the

most-active contract, prices were set for their highest settlement since

March 6, FactSet data show.

Rounding out action on Comex, prices for the platinum group metals also climbed, with July platinum

PLN4

+0.87%

up $14, or 1% at $1,443.90 an ounce and June palladium

PAM4

+1.03%

trading at $807.80 an ounce, up $8.05, or 1%.

Survey: Most Americans ignoring stocks

Nearly three out of four Americans continue to shun stock markets, according to a new survey released Monday.Despite tiny interest returns on savings accounts and CDs, and stock market returns that topped 30% last year, U.S. investors aren’t returning to trading exchanges, says the survey by Bankrate.com, an online aggregator of financial rate data.

The survey found similar results across all income levels and age groups, the company said.“Americans may be avoiding the buy-high, sell-low habit seen in previous market cycles, but only because they’re not buying at all,” said Greg McBride, the company’s chief financial analyst.

The result came from a survey of 1,010 adults aged 18 via landline or cell phone from April 3-6. Researchers from Princeton Survey Research Associates International asked: “Are you more inclined to invest in the stock market now that interest rates on savings accounts and CDs are so low, or not?”

In all, 73% said no, and 22% said yes, while the remaining respondents said they were unsure or declined to answer the question.

The survey had an error margin of plus or minus 3.5 percentage points.

In other results, 45% of those questioned said their overall financial situation today was about the same compared with one year ago. By comparison, 29% said things were better and 25% said the outlook was worse.

Bulls on Main Street go into hibernation

Proving once again that Main Street is still wary of the U.S. stock market after the 2007-09 meltdown, only 27.2% of the members polled by the American Association of Individual Investors said they were “bullish” on the stock market as of last Thursday. That marks the lowest reading since April 18, 2013, when just 26.9% said they were bullish.

“The latest AAII survey showed more bears than bulls for the second week in a row,” says Bruce Bittles, chief investment strategist at R.W. Baird.

The fact that investor enthusiasm has cooled is “encouraging,” says Bittles, as it suggests that investor exuberance and complacency has dipped a bit.

Here’s the two latest readings on bulls vs. bears from the AAII sentiment survey:

Week ending % bulls % bears

4/17/14 27.2% 34.3%

4/10/14 28.5% 34.1%

Long-term avg. 39.0% 30.5%

Source: American Association of Individual Investors

Five things new Ford CEO must do

Mulally, who came from Boeing in 2006, almost miraculously squired Ford through the the dark days without the Chapter 11 bankruptcy reorganizations that General Motors and Chrysler Group underwent. But there's plenty left for his replacement.

Five things the next Ford CEO must do:

Find a reliable substitute for Sync, fast. It's the Microsoft setup that underlies Ford's voice-command system, and it stinks. Sync foul-ups keep Ford low on widely consulted third-party quality and reliability surveys.

Fix Lincoln or dump it. Start by giving the cars real names. Who can keep straight the MKX from the MKZ from the MKT? Sure it's nice to have a luxury brand, but as Cadillac has shown at GM, it takes many years to establish BMW-style credibility, and it won't be done with re-badged Fords.

Get busy in China. "We're clearly late," acknowledges Mulally, but sales there are starting to roll and the car company can't afford to stumble in the fast-growing market.

Stay focused in Europe. The economy's begun to edge back toward health, which will take auto sales with it. Once Europe isn't a huge earnings anchor, the temptation will be to take off the pressure, to slow down on job cuts and factory closings. From a corporate standpoint, bad idea.

Keep Mulally's all-for-one philosophy steaming ahead. It'll be easy to slide back into Ford's notorious fiefdoms without constant pressure from the boss, and those warring fiefdoms are part of the problem that put Ford at the edge of bankruptcy before Mulally took over and smashed the silos.

Act Now To Refinance Your Home Before Rates Rise

(Florida) – There has

never been a better time to refinance your home. That’s because of a

little-known government program called the Home Affordable Refinance

Plan (HARP). This allows Americans to refinance their homes at

shockingly low rates, and reduce their payments by an average of $3,000 a

year.

(Florida) – There has

never been a better time to refinance your home. That’s because of a

little-known government program called the Home Affordable Refinance

Plan (HARP). This allows Americans to refinance their homes at

shockingly low rates, and reduce their payments by an average of $3,000 a

year.

But here’s the catch – like most government programs, this is likely

temporary. Currently the program is set to expire on December 31, 2015.

But the good news is, once you’re in, you’re in. If the thought of a

lower payment or fewer years on your mortgage sounds appealing, the time

to act is right now.It’s like a true middle-class stimulus package

This is unknown to many, but the Home Affordable Program is for the middle class. If your mortgage is $625,500 or less (unless you live in a high-cost area then the loan limits may be higher), you most likely qualify. Basically, the Government wants banks to cut your rates, which puts more money in your pocket (which is good for the economy). However, the banks aren’t too happy about this – here’s why:- You can shop several lenders, not just your current mortgage holder

- Your home’s Loan-to-value (LTV) can be 80% to 125%

- The average monthly savings for most eligible Americans is $250. Can you use an extra $250 a month?

- Many homeowners not only save every month, but depending on their current rates, they can also shorten their term.

- Deferred payments – typically, one or two payments are skipped / deferred as well.

But how do you find these rates?

Here’s the answer – there are a few free websites out there that will compare mortgage rates for consumers, and allow them to choose the best one (that’s a great thing about the internet – it allows you to do business with lending institutions all over the country).LendingTree, one of the country’s largest and most respected mortgage refinance comparison shopping websites, is one of the few companies with HARP lenders on its network, and is currently assisting homeowners like you to obtain further information regarding superb mortgage rates.

With LendingTree there’s no obligation and their service is fast & easy. It takes about five minutes, and the service is 100% free. You have nothing to lose except money stress.

But you do have to act before rates rise.

_______________________________

Last Minute Tax Tips for Business Owners-What if I Can’t Pay All My Taxes?

Bear in mind that regardless of what type of entity your business is established under, an extension to file tax returns is not an extension of time to pay. Therefore, if you anticipate a tax liability, it is important that you remit payment with the extension form.

Depending upon the state in which your corporation does business, a minimum estimated tax payment for the current year is also likely due on April 15. Check with your tax pro or your state taxing agency to determine if this is a requirement and to find out how much to pay.

Sole proprietors and partners in a partnership must pay the first installment of federal and state (if applicable) 2014 estimated tax payments on April 15 as well.

But what if you don’t have enough cash on hand to do both?

If you are unable to meet your 2013 liability and make the first installment of the 2014 estimated, I encourage you to give the 2013 liability priority. The penalties are not as harsh for failure to prepay a current estimated payment as they are for failure to pay the prior year liability. You have the remainder of the year to catch up.

Regarding estimated payments and penalties, the IRS states: “Generally, most taxpayers will avoid this penalty if they owe less than $1,000 in tax after subtracting their withholdings and credits, or if they paid at least 90% of the tax for the current year, or 100% of the tax shown on the return for the prior year, whichever is smaller. There are special rules for farmers and fishermen. Please refer to Publication 505 Tax Withholding and Estimated Tax, for additional information.”

You might be facing another dilemma as well: should you pay your income taxes or pay your payroll tax liabilities. If you are a monthly depositor of payroll taxes, your March liability will be due on April 15. The answer is to always choose payroll tax liabilities over income tax liabilities.

Here’s why: The IRS views payroll taxes as a trust account and that’s exactly what it is. When you promise to pay a person $20 per hour, let’s say, you end up writing a check with net pay equivalent to approximately $15 per hour give or take. The difference between the gross pay and net pay are withholdings: the employee’s federal income tax liability, state income taxes, social security and Medicare taxes (which you are required to match). This is not your money to play with. You are required to turn it over to the government. Failure to do so can create not only severe penalties and interest but the exacting of a civil penalty not on your business but on you personally for $100% of the tax liability.

The severity of a civil penalty may actually put you out of business.

______________________________

Beef Prices Hit Highest Level Since 1987

A dwindling number of cattle and growing export demand from countries such as China and Japan have caused the average retail cost of fresh beef to climb to $5.28 a pound in February, up almost a quarter from January and the highest price since 1987.

Everything that's produced is being consumed, said Kevin Good, an analyst at CattleFax, a Colorado-based information group. And prices likely will stay high for a couple of years as cattle producers start to rebuild their herds amid big questions about whether the Southwest and parts of the Midwest will see enough rain to replenish pastures.

Meanwhile, quick trips to the grocery store could drag on a little longer as shoppers search for cuts that won't break the budgets. Patrons at one market in Lubbock seemed resigned to the high prices, but not happy.

"I quit buying steaks a while ago when the price went up," said 59-year-old Lubbock resident Len Markham, who works at Texas Tech. She says she limits red meat purchases to hamburger, opting for chicken, pork and fish instead.

Fellow Lubbock resident Terry Olson says she buys chicken and eggs now.

"I don't buy (red) meat, period," the 67-year-old said, admitting there's an occasional hamburger purchase. "Not like I used to because of the price."

Restaurant owners, too, must deal with the high prices. Mark Hutchens, owner of the 50 Yard Line Steakhouse in Lubbock, raised his menu prices for beef items by about 5 percent in November. Since then, the owner of the eatery has tried to make cuts elsewhere to avoid passing it on to customers.

"It really squeezes the small guys more," he said of non-chain restaurants. "You just can't keep going up on people forever. I just think you have to stay competitive and keep your costs low."

White-tablecloth restaurants have adjusted the size of their steaks, making them thinner to offset the price increases, says Jim Robb, director of the Colorado-based Livestock Marketing Information Center. Some places now serve a 6-ounce sirloin, compared to 8- or 10-ounce portions offered years ago, he said.

And fast-food restaurants are trimming costs by reducing the number of menu items and are offering other meat options, including turkey burgers, Robb said. Chain restaurants also try to buy in volume as much as they can, which essentially gives them a discount, Iowa State University assistant economics professor Lee Schulz said.

"That can help them when they're seeing these higher prices," he said. "They can't do anything with the high prices."

The high prices are welcome news for at least one group: ranchers, especially those in Texas who for years have struggled amid drought and high feed prices. Despite the most recent numbers that show the fewest head of cattle in the U.S. since 1951, prices for beef haven't declined along with the herd size as demand has remained strong.

But even as ranchers breathe a sigh of relief, some worry lasting high prices will prompt consumers to permanently change their buying habits — switching to chicken or pork. Pete Bonds, a 62-year-old Texas rancher and president of the Texas and Southwestern Cattle Raisers Association, said that's a big concern, especially as younger consumers start to establish themselves.

But such fears may be unfounded, Robb said. Three years ago, economists thought consumers would start finding substitutions for beef as the drought spread. "We're surprised we haven't seen more of that," he said.

South Dakota rancher Chuck O'Connor is optimistic that consumers won't abandon beef for good.

"I'm sure some are maybe going to cut back some, but to say that people aren't going to buy it anymore, I don't think that's going to happen," he said, adding, "I hope not."

Beef isn't the only meat with higher price tags. The price of pork also has climbed, largely due to a virus that has killed millions of young pigs. And composite retail prices for chicken in February were $1.95 per pound, the highest since October.

"I think these higher food prices are here to stay, including beef," said Dale Spencer, a rancher in central Nebraska and the former president of the Nebraska Cattle Association. "As we grow the herd, we'll have more supplies and prices should drop some at the market. I would not say a drastic drop."

The long-term trend, Good said, is that more shoppers will choose cheaper hamburger over higher-priced steaks and roasts.

"There's concern for the future but what's the consumer to do?" he said. "Pay the price or do without."

_______________________________

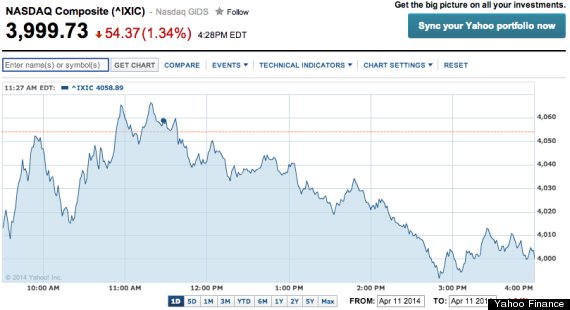

Nasdaq Closes Below 4,000 As Tech Stocks Drop Again

The Nasdaq composite closed out its third losing week in a row.

The Nasdaq lost 54 points, or 1.3 percent, to end at 3,999 Friday. It was only the second time this year the index has closed below 4,000. It's down 8 percent from the high it reached in early March.

The Standard & Poor's 500 fell 17 points, or 1 percent, to 1,815. The Dow Jones industrial average fell 143 points, or 0.9 percent, to 16,026.

JPMorgan Chase fell 4 percent after reporting weaker earnings. Other big banks also fell, including Bank of America.

Bond prices rose. The yield on the benchmark 10-year Treasury note fell to 2.62 percent.

_____________________________

Toyota to recall 6.4 million vehicles with defects.

The company found five types of safety hazards in vehicles including such top sellers as the Camry sedan, RAV4 sport-utility vehicle, and Corolla compact car, according to a statement Wednesday. The carmaker is not aware of any injuries or fatalities linked to the defects, it said.

The announcement, covering years as far back as 2006, is a sign of a more aggressive approach to recalls at Toyota, analysts said. Last month, the Justice Department ended a four-year investigation of the automaker, imposing a $1.2 billion criminal penalty after finding that the company concealed information about defects that caused sudden, unintended acceleration in several models. The penalty was the largest ever levied on an automaker.

“They’re making a very bold statement that they’re going to stay on top of those recalls, no matter what the impact,” said Alec Gutierrez, a senior analyst at Kelley Blue Book, an automotive research firm. “Toyota took this opportunity to say ‘We are going to go through the list of all the known problems, and issue as many recalls as necessary.’”

There was no indication that US safety regulators had opened any investigations.

The largest recall involves 3.5 million vehicles equipped with a spiral cable that can be damaged when the steering wheel turns. The frayed cable could cause a warning light to illuminate and could deactivate air bags.

Another recall is aimed at repairing seat rails containing springs that could break, particularly when seats are frequently adjusted. When the springs break, the seat will not lock in place and could move in a crash, increasing the risk of injury, the company said.

A third recall involves fixing steering column brackets installed in some European and Asian models that can become unstable when the steering wheel is repeatedly turned with maximum force.

The other recalls address problematic windshield-wiper motors and the possibility of fires in starter motors. Those problems are confined to models sold in Asia, Toyota has said.

Of the vehicles being recalled in the United States, Toyota said it would service 1.3 million to fix the air bag defect and 472,500 vehicles to fix their seats.

In its report to the National Highway Traffic Safety Administration, Toyota said it began tracking the problem with air bags in 2011 because of an increase in customer complaints.

While the air bag wiring was used on many Toyota models, the company concluded in 2012 that certain characteristics of its Tacoma pickup made failures more likely. It recalled about 481,000 Tacomas in the United States later that year.

The automaker continued to track the issue, and this month concluded that a wider recall was necessary, according to its filing.

_________________________________

South End hostel sold to developer for $17.2m.

A Boston real estate firm has purchased a South End hostel and plans to redevelop the property as a college dormitory or a modern boutique hotel that would cater to young business travelers.

Mount Vernon Co. acquired the eight-story building at 40 Berkeley St. for $17.2 million from a partnership that includes a former Boston Redevelopment Authority director, Mark Maloney, and Georgia Murray, chair of the Rose Fitzgerald Kennedy Greenway Conservancy.The sale is the latest in a wave of transactions in the South End, where several large projects are taking shape:

■ The Ink Block project, on the old Boston Herald site, with 475 residential units and a Whole Foods store.

■ Two apartment buildings with about 600 units and street-level retail at 345 Harrison, where the Graybar Electric building will be demolished.

■ 275 Albany St., with up to 380 homes and stores.

■ A large office and retail building, planned for Washington Street.

Bruce Percelay, founder of Mount Vernon Co., said he will not make any decisions about 40 Berkeley until he meets with neighbors and city officials. He said three colleges have approached him about leasing the property for their students. He declined to identify the schools.

Although 40 Berkeley has a rare dormitory license, Percelay said he might renovate the building as a boutique hotel that would feature small rooms and large common areas. It currently is operated as a lodging with private rooms, but many of them use shared bathrooms.

Boutique accommodations have become popular among young business travelers in New York City. Hotels such as The Jane, a renovated former dormitory for sailors, advertise free bicycles and Wi-Fi for guests who favor an ambiance that’s more funky than elegant. Percelay said he wants to strike that tone at 40 Berkeley, a former YWCA that is now one of a few budget hotels in Boston.

“Our goal would be to preserve the building’s position as one of the more affordable entry level hotels but add an exciting vibe that would appeal to young travelers,” he said.

Mount Vernon Co. owns more than 1,500 apartments in Boston but has recently purchased hotels and inns in Nantucket and Portsmouth, N.H.

Boston’s hotel market is booming again after several slow years during the economic downturn. Developers are planning hotels from Roxbury to the Back Bay to the South Boston Innovation District.

Patrick Moscaritolo, president of the Greater Boston Convention & Visitors Bureau, said demand is high for moderately priced boutique hotels — accommodations that would be a counterpoint to those that charge $300 to $400 per night.

________________________________________

Patrick looks to eliminate tech noncompete agreements.

The proposal is certain to inflame a battle within the state’s business community between larger, established corporations that say noncompete agreementsprevent former employees from spreading business secrets and venture capitalists who contend they stifle innovation and undermine the state’s reputation as a haven for startups.

“We feel like noncompetes are a barrier to innovation in Massachusetts,” said Greg Bialecki, secretary of Housing and Economic Development.

The administration's proposal is modeled after California’s, one of the few states to ban noncompete clauses in employment contracts. That state’s business regulations essentially declare the clauses in employment contracts void, and California courts have largely declined to enforce them in legal disputes.

“When you look at California, the big and small tech companies out there have clearly figured out a way to do business without compromising intellectual property,” Bialecki said. “Not only are they doing well, they’re doing fabulously.”

In exchange for banning noncompete agreements, Patrick wants Massachusetts to adopt the Uniform Trade Secrets Act, which prevents workers from taking companies’ intellectual property to other businesses but leaves them free to join or launch competitors whenever they want. Some 46 states, including California, have adopted the Uniform Trade Secrets Act, as well as Washington, D.C.

Patrick’s position on noncompete agreements has evolved dramatically over his time in office. On several occasions earlier in his term, he said he recognized pros and cons. Then last year Bialecki told a legislative committee the governor had concluded noncompete agreements hurt the state’s economy. The issue has been raised before in the Legislature and gone nowhere. Now, with less than one year to go in office, Patrick is putting his name behind the controversial idea.

Spokesmen for House Speaker Robert A. DeLeo and Senate President Therese Murray declined to comment.

The noncompete clause is probably the most controversial element of legislation Patrick will unveil Thursday. He also is proposing new spending for programs to promote technology jobs and is pushing an unusual effort to retain foreign students who want to stay in Massachusetts after college or graduate school.

Many can’t get a work visa through the main program, called H-1B, that the US government administers for foreign workers. The Patrick administration said it identified a provision of immigration law that grants temporary visas to participants in certain programs — hence an Entrepreneurship in Residence program, in which foreign graduates agree to work at local universities part time while developing business ventures.

The foreign worker visa program has been controversial. In Massachusetts, the visas are mostly used by technology firms that contend they cannot find enough local workers with the necessary technical prowess. But critics of the program say the companies are exploiting the visas to find a cheaper source of labor. Still, Patrick’s visa proposal is not apt to generate anywhere near the battle on Beacon Hill that the proposed abolition of the noncompete clause will.

Typically, noncompete pacts prohibit employees from signing on with another company in the same field, often for one or two years. They are widely used in many industries. And they have a long history in Massachusetts, said Andrew Botti, an employment lawyer for companies and former chairman of the Small Business Association of New England, which previously opposed bans on noncompete clauses.

“This has been the law in Massachusetts for 200 years, and I’d say the Massachusetts high-tech economy has grown pretty well in the past 200 years,” Botti said. “It’s sad but true that when a lot of employees leave their companies they take things they shouldn’t be taking. And that information is used to compete unfairly with their previous employers.”

One of the state’s largest technology companies, EMC Corp., opposes Patrick’s plan.

“The legitimate business interests of companies in Massachusetts are well served by the longstanding case law that allows covenants not to compete,” said Paul Dacier, EMC’s general counsel. The Hopkinton data-storage giant has vigorously enforced noncompete agreements.

Patrick appears mindful of the concerns. His legislation would allow businesses to continue limiting certain activities by former employees, such as stealing clients; nondisclosure clauses, which prevent former employees from talking publicly about private matters, also would be unaffected.

Bialecki emphasized Patrick wants only to stop the practice of large firms blocking workers from jumping to hot new startups or striking out on their own.

The governor has been heavily lobbied by the startup community, young entrepreneurs, and their backers.

“This is just about allowing people to have the freedom and flexibility to pursue the best opportunities,” said Jeff Bussgang of the venture firm Flybridge Capital Partners, who has spoken to Patrick directly.

The big concern of venture capitalists and entrepreneurs is that such clauses hamstring Massachusetts in its competition with arch-rival California, the only state with a much larger high-tech economy.

Some economists have suggested California’s freer job market — not merely its warmer climate — is a key reason why it surpasses Massachusetts. A 2010 study by professors at Yale University and Brock University in Ontario, which cited California and Massachusetts as examples, concluded that “the enforcement of noncompete clauses significantly impedes entrepreneurship and employment growth.”

States that bar noncompete agreements attract more venture capital and generate more startups and patents, the researchers found.

Interestingly, several business groups whose members are among the staunchest supporters of noncompete clauses said the issue no longer is so cut and dried. The Small Business Association of New England, for example, said companies could use clearer guidelines about what restrictions can be enforced, especially because defending noncompetes can be prohibitively expensive.

The head of one of the state’s biggest technology business groups, Chris Anderson of the Massachusetts High Technology Council, said his group is so far neutral on the issue. But he acknowledged a “growing sentiment” that noncompete pacts are making Massachusetts “less competitive” and that other laws on trade secrets and intellectual property may be enough to “deal with the concerns of large technology employers.”

Another factor is the debacle over the short-lived tax on computer-related software and services that Patrick tried to impose last year. Faced with a sudden backlash, an embarrassed Patrick and the Legislature swiftly repealed the tax and pledged to pay more attention to the startup community.

“The tech tax sent the absolute most negative signal that you could send about how Beacon Hill understands our technology economy and what drives it,” Anderson said. If the Legislature takes action to undo the noncompete law, he said, “it could help reverse that negative perception.”

_______________________________________

France just might be growing more tolerant of disruptive outsiders.

Patrick Drahi, a Moroccan-born, Swiss-resident, Franco-Israeli billionaire who has just won a bitter takeover battle for SFR, a telecoms operator, happens to be both. It was a striking victory over the Bouygues family, a powerful industrial clan at the heart of the establishment, who were backed by a clutch of other well-connected family businesses, a state investment agency, a big union, and above all by the industry minister, Arnaud Montebourg. This is quite a feat in a country where disruptive newcomers have rarely been made welcome at the big-business high table.

Mr Drahi attributes his win to the simple fact that his was a better project than Bouygues Telecom’s, and logic prevailed. Others argue that the board of Vivendi, the media group that was selling SFR, is stiff with unusually independent-minded men whose backs were put up by the public pressure that the Bouygues family and their chums brought to bear.

Even so, it is not implausible to see in it the beginnings of a sea-change in French capitalism. The long-standing assumption that with the state’s blessing, the destinies of entire industries should be overseen by a charmed circle of interconnected people from the grandes écoles and the haute bourgeoisie seems to be wearing thinner these days. One line in Mr Drahi’s CV implies he is part of that circle—he attended the elite École Polytechnique—but rather than continuing on the usual route via public service and politics to the top of a giant French corporation, the son of humble Moroccan teachers pursued a rather Anglo-Saxon career as a buyer, seller and stitcher-together of cable and telecoms companies around the globe, alongside buy-out firms.

Not many such disruptive outsiders have risen to the very top, but there are a few. One is Xavier Niel, founder of Iliad Group, a mobile-phone operator that has grown fast by drastically undercutting its rivals’ prices. The co-owner these days of Le Monde, a newspaper, and partner of the daughter of Bernard Arnault, boss of LVMH, a luxury group, Mr Niel is being clasped to the establishment’s bosom. Another iconoclast is Jacques-Antoine Granjon, the billionaire co-founder of an early online-retail business, Vente-privée.com.

More shaking-up is on the cards. France’s business climate is changing as its flagship companies go global. Some are now run by foreigners—for example, Sanofi, a pharmaceuticals giant with a German chief executive, its first non-French boss. Others have shifted senior management overseas: Essilor, the world leader in corrective lenses, is mainly overseen from Texas these days. And foreign investors, with their Anglo-Saxon expectations of corporate governance, own around half the shares of the biggest firms, the CAC-40.

There is another reason, too, why France is set to become more open to entrepreneurs, outsiders and disrupters. “France’s back is to the wall economically,” says Mr Drahi, “President Hollande has realised that only enterprises create jobs and Manuel Valls, the new prime minister, is already pushing that line.” Just as François Mitterrand, elected president in 1981 on an intensely socialist platform, had to change tack to woo back business and save the economy, so François Hollande has begun to do the same. Among the 1980s returners, from self-imposed exile in America, was Mr Arnault, a disruptive force in his day. Helped by the French state, he acquired the kernel of what was to become the world’s largest luxury group.